At the 2025 FMI Supply Chain Forum, our CEO and co-founder Ricky Ashenfelter spoke on one of his favorite topics – excess inventory. He offered the manufacturers and retailers in attendance an inside look at the state of the value channel, and how they can collaborate to create not just a positive experience for consumers, but for their own bottom lines as well. We thought his advice was valuable far beyond Breakfast Bites! Read on for a recap of his talk…

The Value Channel is Vast

Everyone loves a deal. But especially for the 60% of Americans who are living paycheck to paycheck–they need creative ways to put nutritious foods on their family’s tables. To meet this demand, discount retailers like Dollar General, Lidl, and Aldi are continuing to grow through tight operating models, including private label initiatives that run counter to branded priorities.

However, there’s another segment of the discount channel that is more oriented around creating a treasure hunt for consumers. In this discount retail segment, with few exceptions, consumers don’t always know what they’re going to get when they walk into a store. That is because this segment is merchandising anywhere from 25 to 75% of their inventory through opportunistic buying.

At Spoiler Alert, we sit at the intersection of suppliers who are attempting to make the most out of circumstances that have given rise to excess inventory at their manufacturing plants and distribution centers, and discount retailers who have built their businesses around partnering with these suppliers during these situations.

We power the liquidation programs for top CPG brands, which are selling excess inventory to retailers representing tens of thousands of locations across the country. These trading partners have processed close to $5 billion of inventory sales through our platform over the last few years, so let’s just say we know a bit about this market. Based on our experience liquidating 1.8 billion pounds of CPG closeouts through our software platform, we have six recommendations for how supply chain leaders can increase cost-recovery and sell-through rates, and prove that excess inventory is something companies should be proactively prioritizing, not simply hoping will solve itself through forecasting perfection.

Tip #1: Acknowledge Excess

The first tip for better excess inventory management is this: acknowledge you have excess inventory. Having processed almost one million transactions for big and smaller CPGs alike, we can confidently conclude that everyone has it, but for some reason, no one wants to talk about it. That ends now.

The most common reasons for excess inventory are forecasted excess and short-dated products. One of the unique attributes of discount retail is that consumers are comfortable with strong discounts in exchange for a shorter shelf-life.

Seasonal products are another example. For discount shoppers, though, having access to pumpkin spice products in the winter or peppermint-themed items in the spring is all part of the hunt.

Another reason we feel excess is inevitable is that our friends in Marketing and R&D are constantly trying to predict the next consumer trend or flavor breakthrough. We all know the failure rates on innovation items, but it’s understood to be one of the de-facto growth pillars of the industry’s future. Rest assured, this segment of retail is often agreeing not to promote its prices online, which helps overcome concerns of channel conflict.

Often, suppliers and retailers collaborate on packaging-related changes, such as rebrands or resizing. Bulk, industrial, foodservice, and away-from-home items are another example.

Regardless of where your CPG is, we’re confident that at least a few of these examples resonate. If you’re in growth mode as a business–either through a ramp-up of innovation or by acquiring other brands–you’re going to have excess as you figure out supply and demand planning. The only question is, how will you use it to your advantage?

Tip #2: Adjust Pricing According to Shelf-Life

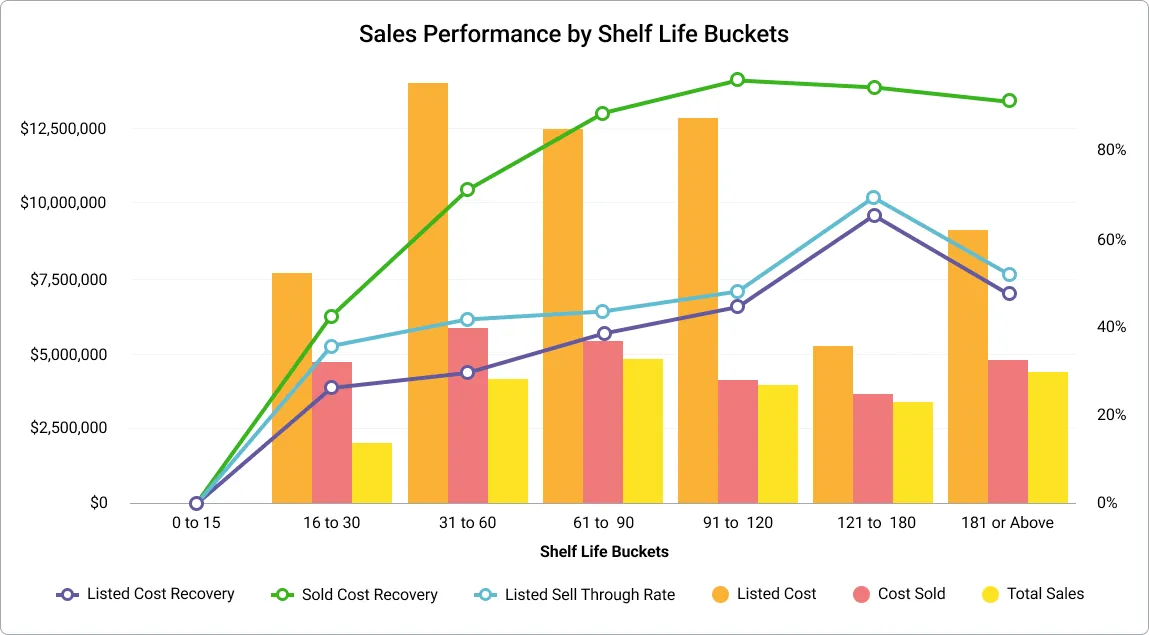

At Spoiler Alert, our data shows that there is a strong correlation between days of remaining shelf-life and willingness to pay. While many suppliers stop attempting to sell inventory way too soon, certain buyers also stop participating when dating is too narrow.

This might seem intuitive, but most sellers aren’t applying this principle in the field – either because their sales teams don’t have enough time in their day to build this into the offers, or they don’t have the right tools or data to price accordingly. We’ve done the analysis across departments and categories, and the trend is always the same: days matter when it comes to short-dated inventory.

Tip #3: Build Relationships with Multiple Buyers

Far too often, major companies sell 80%+ of their excess inventory to a single retailer or wholesaler. Across nearly $5 billion of analysis, we see that programs with more buyers do better.

To be fair, it’s been a bit of a roller coaster ride in the discount retail market the last year and a half. For some, it’s been great. For others, not so much, especially when you consider that debt burdens and operational inefficiency sank some of the largest players in the industry.

The bankruptcies of 99 Cents Only and Big Lots, in particular, were most disruptive to the excess inventory landscape - and for two distinct reasons. For 99 Cents Only, they were one of the only major closeout buyers with a substantial refrigerated and frozen section. Big Lots was, for many companies, the #1 buyer of closeouts, reinforcing that having too many eggs in a single basket is both problematic and avoidable.

However, other big players in discount retail are still thriving. Grocery Outlet continues to be the largest partner for food brands, given their temperature-class assortment looks and feels the most like a traditional grocer. The growth of their private label program, however, is a trend we expect all CPGs to keep an eye on.

Ollie’s on the other hand, continues to outperform the market and is aggressively ramping up its CPG merchandising and assortment. All CPGs should strive to maintain great relationships with both - and many more. Which brings us to…

Tip #4: List Competitively

Sometimes a Right of First Refusal (ROFR) relationship with a preferred buyer makes sense. However, we advise manufacturers to carefully consider these arrangements and weigh the pros and cons of this listing strategy. A few common pitfalls of ROFRs are:

1. It makes your other trading partners feel less special to be stuck with leftovers following the preferred buyer’s cherry-picking; and

2. It takes away your ability to get pricing signals–specifically, whether you’re setting the right expectations (internally and externally) for what the market will pay for that product.

Buyers are pursuing the most recognizable brands, and they’re willing to collaborate on the best and most challenging to items secure the best assortment for their customers. Our data at Spoiler Alert often doesn’t support ROFRs, and we can help manufacturers navigate this evaluation.

Tip #5: Be Logistically Aware and Flexible

This tip means that, to the extent possible, suppliers should accommodate both delivered and customer pick-up models. Closeout buyers come in all different shapes and sizes, with full truckloads and less-than-full truckload options scattered all across the country. Suppliers shouldn’t rule out any offers or buyer profiles without doing the math first.

A simple example… A manufacturer evaluates a higher offer from one buyer who expects the product to be delivered, and a lower offer from a buyer willing to pick-up the inventory themselves. It may come as no surprise that some sales teams choose what is better for the top line, but not the bottom line.

Tip #6: Remember That It Takes a Village

Which brings us to our last tip for navigating the discount retail market and managing excess inventory: it takes a village.

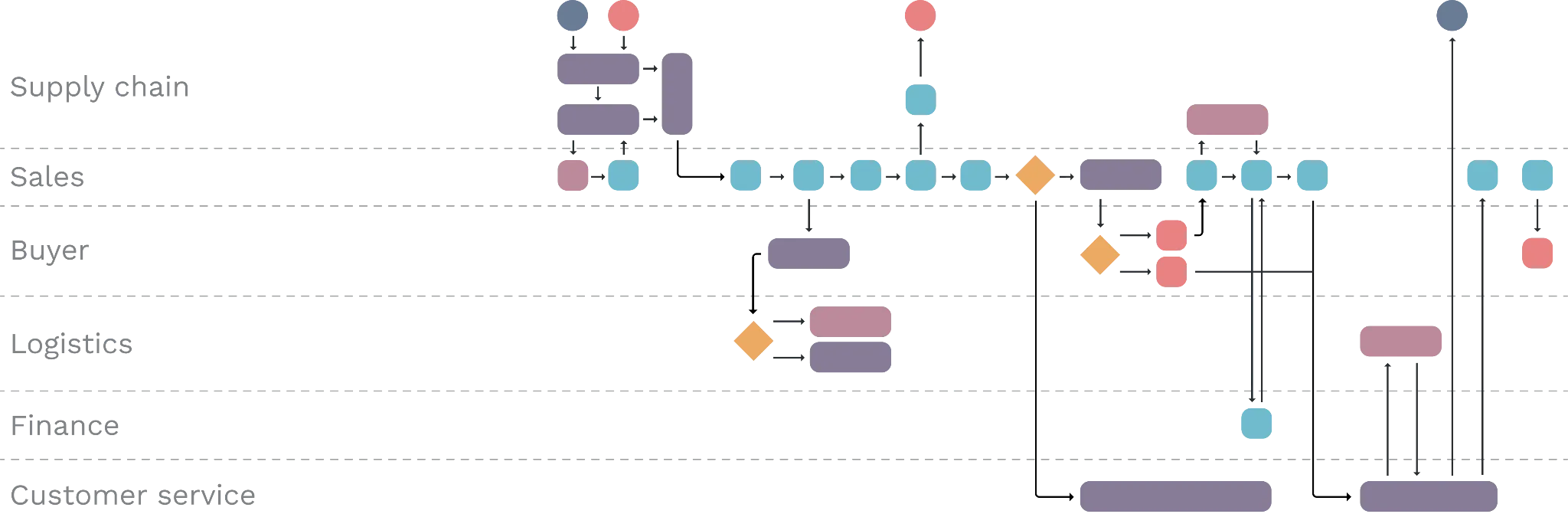

The best programs start with identifying which inventory is at-risk and determining the most effective ways to move it out of your warehouses, with buy-in not just from Supply Chain, but also Sales and Finance for pricing guidance and guardrails. Only then can an excess inventory management program work to its fullest potential.

And there you have it, our tips for tackling excess. If you’re dealing with excess (see tip #1), and would like even more advice on your inventory management program from our team of experts, we’d love to chat more with you. Book time to speak with our team today!

.webp)